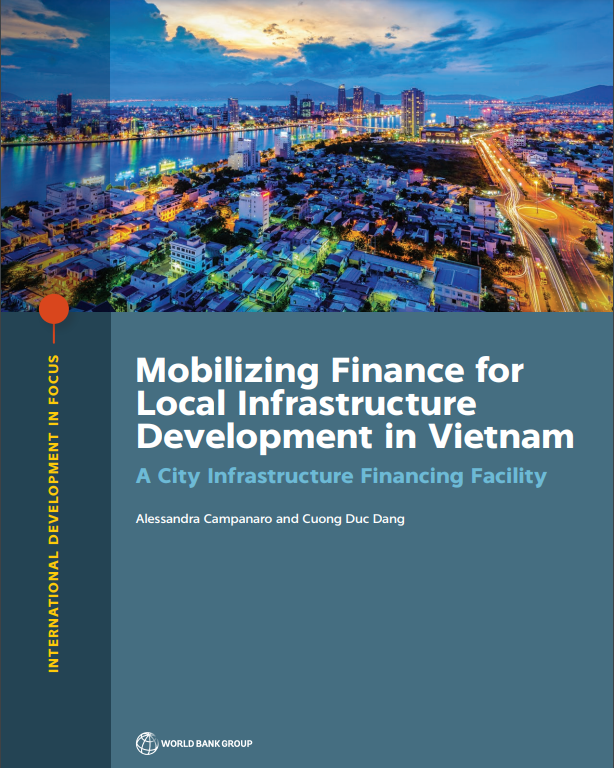

Mobilizing Finance for Local Infrastructure Development in Vietnam : A City Infrastructure Financing Facility

Editorial: The World Bank Group

Licencia: Creative Commons (by)

Autor(es): Campanaro, Alessandra y Duc Dang, C.

Vietnam stands out as one of the most dynamic emerging countries in the East Asia and Pacific region. Since major reforms in the 1990s, the country has experienced an annual average growth rate of 6-7 percent, and extreme poverty rate has fallen from over 50 percent to 3 percent. Yet, the rapid growth and decentralization process have brought significant pressure on provincial governments in terms of local infrastructure investments and urban services delivery. With an annual shortfall of US$9 billion in funding for local infrastructure investments, provincial governments in Vietnam need to move toward a more market-driven financing model. This transition will require enhanced financial and technical capacity of local governments as well as an enabling environment for subnational borrowing. This report explores the development of a pilot financial instrument that could catalyze the subnational borrowing market in Vietnam. The report presents the findings of three assessments, which focused on (a) the borrowing capacity and creditworthiness of selected provincial governments, (b) the capacity of the commercial banking sector to invest in provincial governments, and (c) the current status of Vietnam's regulatory framework. The findings of this report will be useful to policy makers in Vietnam, providing an understanding of the key issues associated with a shift toward a more affordable and efficient local infrastructure financing model and presenting a preliminary roadmap for development of a pilot instrument. The report will also be of interest to policy makers in other transition countries that are facing similar challenges.

[Washington: 2018]

Compartir:

Una vez que el usuario haya visto al menos un documento, este fragmento será visible.